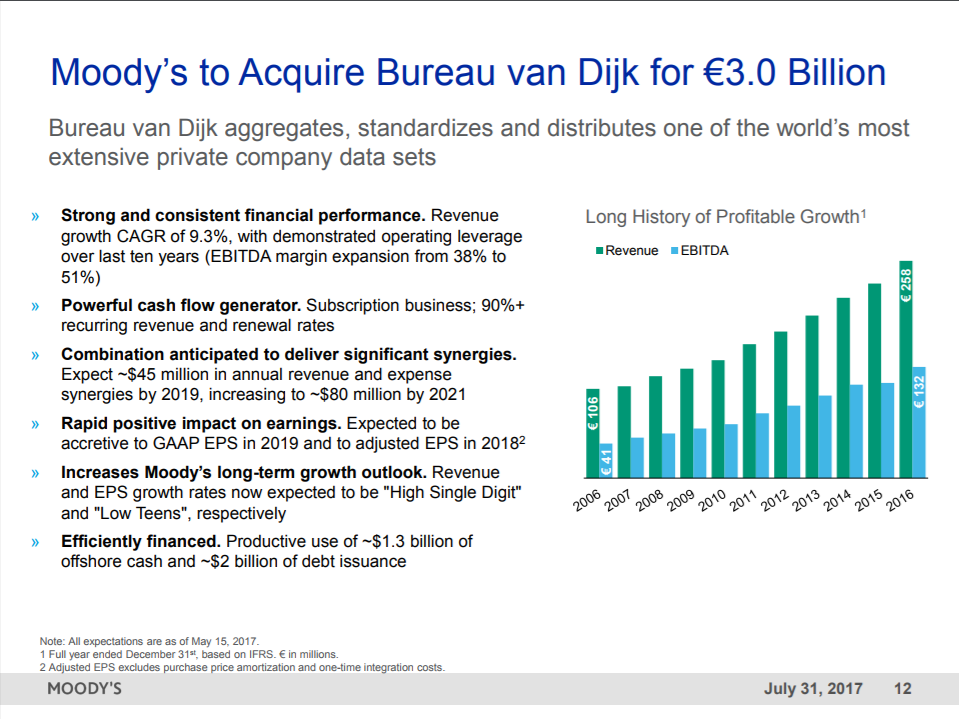

With a multiple of 22.7, the price paid by Moody’s for Bureau van Dijk is high by any standard and the acquirer must be expecting very substantial synergies for the deal to make sense from a financial standpoint. Moody’s includes Moody’s Analytics, which offers software, advisory services and research for credit and economic analysis and financial risk management, and Moody’s Investors Service, which provides credit ratings and research covering debt instruments and securities.īoth activities are information-intensive and should benefit from a closer association with Bureau van Dijk.įurthermore, this acquisition is significant to the global employee benefits industry because Bureau van Dijk owns Orbis, the largest database of information about multinational corporations. Orbis is Bureau van Dijks flagship database of private and listed company information from around the world - all standardized for easy cross-border comparisons. Bureau van Dijk generated revenues of EUR 258 million and EBITDA of EUR 132 million in 2016. Orbis covers companies in every country with overall coverage that will soon surpass 400 million. Specifically, Bureau van Dijk introduced a matrix sales structure, implemented a global CRM system, and expanded the salesforce it also developed new products, launched a new user interface, and made substantial investments in marketing and corporate branding. We earned this continued recognition because of Bureau van Dijk’s Orbis entity data solution.

Information is sourced by Bureau van Dijk from annual reports, information providers and regulatory. 4 1 star 0 See all 24 Orbis reviews 24 reviews Save to My Lists Claimed This profile has been claimed by Orbis, but it has limited features. In the Orbis database you can find industry reports produced by.

It aggregates approximately 160 different information sources.ĮQT had acquired Bureau van Dijk in September 2014 and subsequently reorganized it, focusing on sales. Orbis Bank Focus is a new database of banks worldwide. industry researchIBISWorldOrbis - Bureau van DijkProQuestBusiness Source Ultimate. The transaction is expected to close in the third quarter of 2017.īureau van Dijk, with headquarters in Amsterdam, The Netherlands, captures, processes, standardizes, and distributes a dataset about private companies around the world, with coverage of more than 220 million companies. Swedish alternative investments firm EQT in May 2017 sold Bureau van Dijk to Moody’s for EUR 3.0 billion.

0 kommentar(er)

0 kommentar(er)